28 Rate Gain Worksheet Calculator

If you excluded 60% of the gain, enter 2 / 3 of the allowable exclusion for the year; If the result is a gain, it must be reported on line 13 of the 1040 form.

Irs Form 1040 Qualified Dividends Capital Gains Worksheet

Form 8949 part ii includes a collectibles gain.

28 rate gain worksheet calculator. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Lacerte calculates the 28% rate on capital gains according to the irs form instructions. What is the 28 rate gain worksheet used for?

Both of the following are true: To view the tax calculation on the. Api's capital gain tax calculator to calculate taxable gain and avoid paying taxes by taking advantage of irc section 1031.

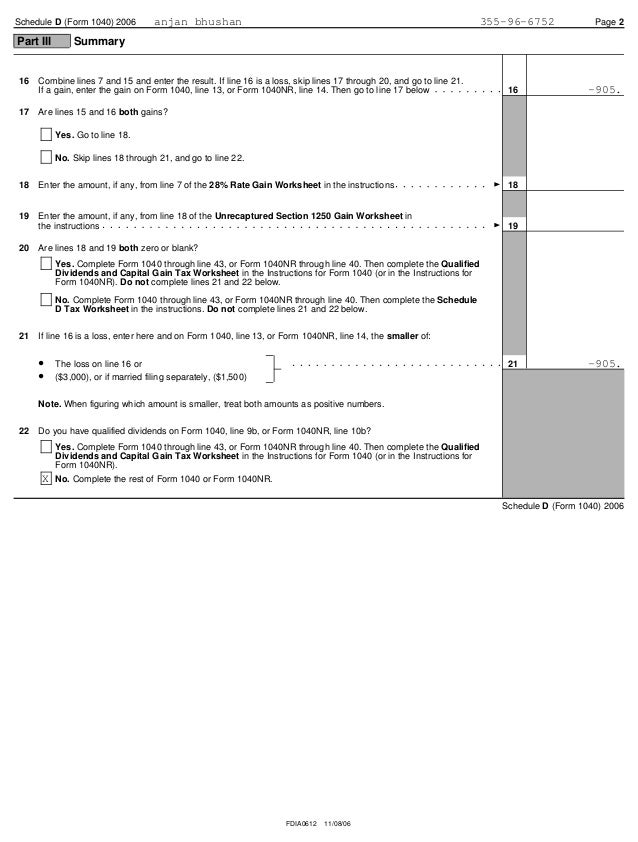

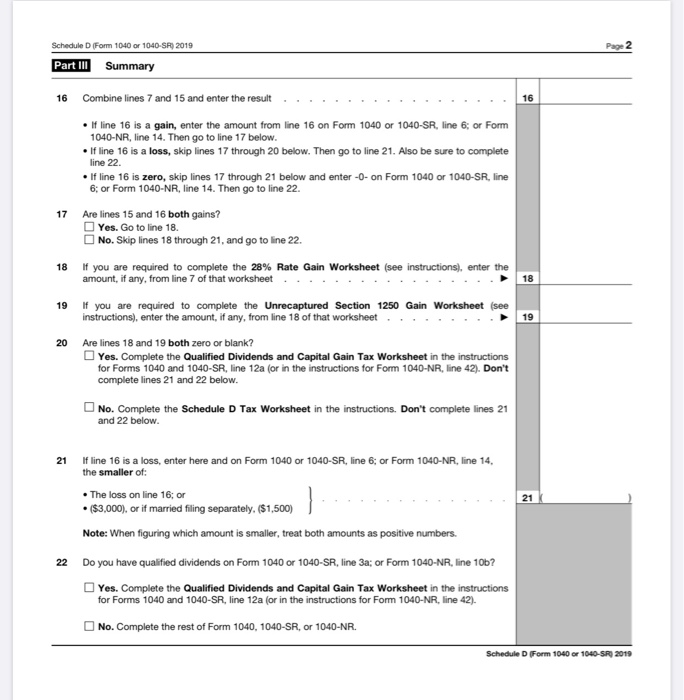

Before completing this worksheet, complete form 1040 through line 10. Per the instructions, the 28% rate will generate if an amount is present on schedule d, lines 18 or 19. A form 1040 taxpayers regular tax calculation using the worksheet is potentially affected if.

Clude that amount on line 4 of the 28%. You will need to complete the 28% rate gain worksheet in the schedule d instructions. May 17, 2019 — the irs noted the impacted returns as follows:

You will need to complete the 28% rate gain worksheet in the schedule. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced automatically as needed, but there are amounts that may need to be entered on either worksheet by the preparer. Where is the capital gains worksheet?

Calculating the amount of qualified dividends. Had 28 % rate gain (taxed at a maximum rate of 28%) reported on line. Schedule d line 18 or line 19 is more than zero or both are more than zero.

Math for 5 year olds worksheets free multiplication worksheets printable 2nd grade grammar worksheets 28 rate gain worksheet 1st grade sight words worksheets 2nd grade language arts worksheets inequality and graph calculator math show work multiplying 3 fractions worksheet multiplying 3 fractions worksheet coolmath4you equation games for. Where is the 28% rate gain worksheet? 28 rate gain worksheet online solutions help you to manage your record administration along with raise the efficiency of the workflows.

If you are completing line 18 of schedule d, enter as a positive number the amount of your allowable exclusion for the year on line 2 of the 28% rate gain worksheet; March 14, 2019 by leo garcia. Of the gain, • ²⁄ 3 of any section 1202 exclusion you reported in column (g) of form 8949, part ii, with code "q" in column (f), that is 60% of the gain.

1st grade sight words worksheets. If you excluded 100% of the gain, don't enter an. It was originally a product developed in mexico.

It is called the qualified dividends and captial gains tax worksheet. If you checked yes on line 17, complete the 28% rate gain worksheet in these instructions (page 10) if either of the following applies for 20xx: Monique moore on ##top## 28 rate gain worksheet irs.

Capital gains are taxed at the same rate as taxable income — i.e. How do you calculate qualified dividends? If you excluded 75% of the gain, enter 1 / 3 of the allowable exclusion for the year;

See the schedule d instructions for line 12. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains and losses, according to the irs, the tax is calculated on the schedule d tax worksheet instead of the qualified dividends and capital gain tax worksheet. Per the instructions the 28 rate will generate if an amount is present on schedule d lines 18 andor 19.

If you don't have to file schedule d and you received capital gain distributions, be sure you checked the box on line 13 of schedule 1. If lines 18 or 19 have amounts then line 20 will check the box no and complete the schedule d tax worksheet which goes through the various tax rates (15%,… The worksheet used to calculate your taxes when taking capital gains into account is found in the irs instructions for form 1040.

Calculating the capital gains 28% rate. If you earn $40,000 (32.5% tax bracket) per year and make a capital gain of $60,000, you will pay income tax for $100,000 (37%. Form 8949 part ii includes a section 1202 exclusion from the eligible gain on qsb stock, or.

28 Tax Gain Worksheet Worksheet Resume Examples

Capital Gain Loss Transaction Worksheet Instructions

Qualified Dividends and Capital Gain Tax Worksheet 2019

1040 28 Rate Gain Worksheet Worksheet Template Design

1040 28 Rate Gain Worksheet Worksheet Template Design

1040 28 Rate Gain Worksheet Worksheet Template Design

28 Tax Gain Worksheet Worksheet Resume Examples